Sample report part 1: FRR Management Summary

The predictability offered by a secure supply chain is worth its weight in gold. The BAMAC GROUP’s Financial Risk Report enables you to obtain this information. In this article, we will use an example report to show you what information and benefits you can gain for your company from the Financial Risk Report.

The Financial Risk Report: your tool for fact-based decisions.

Can your suppliers meet the current financial challenges as a company? Is your supplier financially stable enough for the intended collaboration? The predictability offered by a secure supply chain is worth its weight in gold. After all, planning security is an important success factor for companies. BAMAC Group’s Financial Risk Report enables you to obtain this information.

Get clarity

In this article, we give you an insight into the BAMAC GROUP’s Financial Risk Report. Using an example report, we will show you what information and benefits you can gain for your company from the report. For example, the report answers the following questions.

- How likely is it that your suppliers will get into financial difficulties?

- To what extent do current events such as supply bottlenecks and high energy prices affect the reliability of your supplier?

- Do your suppliers have the necessary substance to overcome unexpected challenges?

An effective supplier evaluation helps companies to identify risks and take appropriate measures to minimize them. A key aspect of this assessment is the financial health of suppliers. The diagram illustrates BAMAC Group’s financial risk reporting process. We have outlined further advantages of the supplier evaluation with the FRR in our blog before.

Let’s be more specific. Below you will find a sample management summary of our Financial Risk Report. In the second quarter of 2022, we valued Muster AG on behalf of one of our clients.

First key figures from the Financial Risk Report of Muster AG

Financial period: June 30, 2022 / fiscal period Q2 2022

FRR Creation date: July 28, 2022

Stock exchange symbol: MAG

Sector: IT services

Financial Risk Rating (FRR): 54

Risk level: Medium

Forecasted probability of default: 0.19%

Annual delta: -12 rating points

Company substance: 43 (Medium)

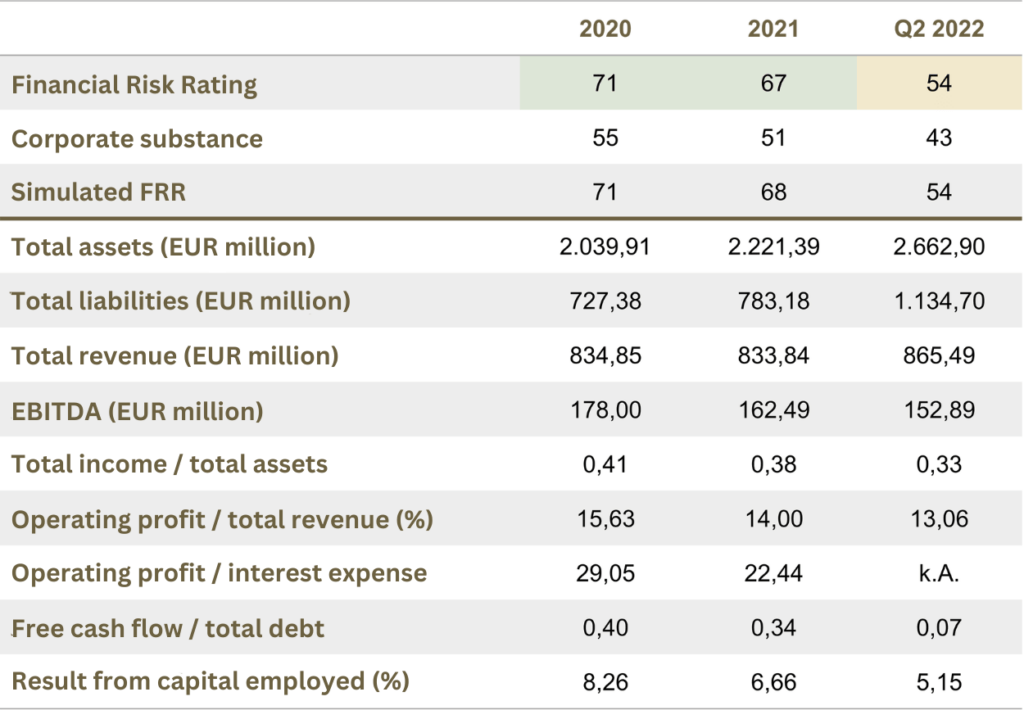

Overall, it can be stated that this report determines a financial risk rating (FRR) of 54 points (0 = very high default risk, 100 = very low default risk) for Muster AG for the four quarters up to June 30, 2022, which corresponds to a downgrade of 12 points compared to the previous year. This rating puts the company in the upper half of our medium risk group, with an estimated probability of default of 0.19% over the next 12 months. This FRR and the estimated default risk are the result of a medium-sized company with an appropriate level of debt, liquidity and earning power. You can see the above figures and developments in the chart below.

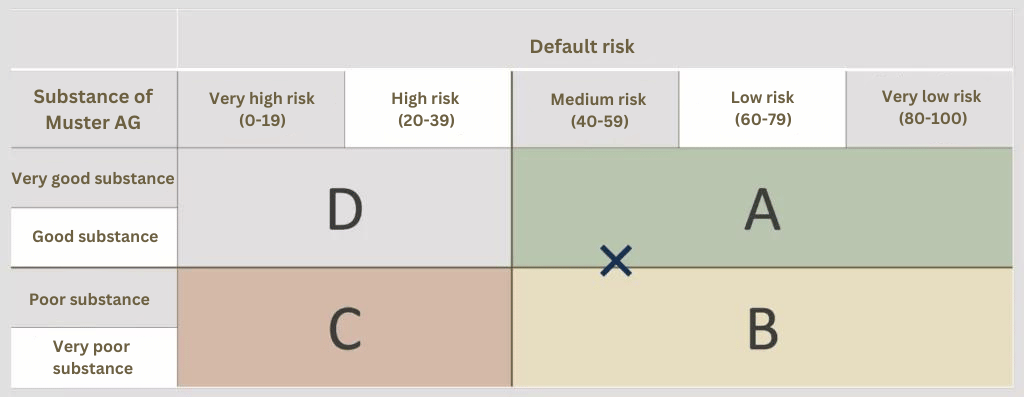

Medium default risk & medium company substance

As can be seen from the figure, the corporate substance of Muster AG is 43 points, this result indicates an acceptable level of efficiency of the evaluated company. In the long term, however, this rating also requires improvement if Muster AG is to remain viable. Appropriate performance is available within the resilience indicators. These resilience indicators are particularly relevant when considering the risk of default. Companies with such a combination of corporate substance and resilience have an acceptable risk of default within the next year, combined with comparatively modest medium-term prospects.

Sufficient resilience

According to the Financial Risk Report, Muster AG has adequate performance in terms of leverage, liquidity and earnings development. That is an acceptable result.

Relative underperformance in the generation of returns

At 5.15%, the return on capital employed (ROCE) for the most recent period represents a relative underperformance and is a significant decline compared to the previous full year, which at 8.26% was the low point of the period under review. This figure is well below the high of 15.95% reached in the second quarter of 2013. In the last three years, the range was between 5.15% and 13.96%.

Average corporate substance

In the past 12 months, starting from June 30, 2022, Muster AG has suffered a moderate decline in the substance of the company. The decline of 9 points in the corporate substance is largely due to a deterioration in operating profitability, net and gross profitability and the efficiency of the capital structure. The efficiency of the cost structure is at a high level compared to the global data set. This area makes an important positive contribution to the overall strength of the company. The Financial Risk Report also shows that Muster AG has weaknesses in terms of capital structure efficiency and operating profitability in a global industry comparison.

Inconsistent cash flow

While Muster AG generated a positive cash flow from its operating business in the last financial year, overall performance was mixed. Payment coverage for investments was very high, whereas debt coverage was modest.

The quintessence of the Financial Risk Report

With these results, Muster AG is in the upper half of our medium risk group with a mixture of strong and weak performance categories. The company has a relatively underperforming ROCE and was downgraded in the last period. If current trends continue, it is to be expected that Muster AG will be confronted with a medium to moderate default risk in the coming year. The prospects for efficiency and competitiveness are promising in the medium term, which is why the outlook for the company is rated as positive. The following chart illustrates the default risk in relation to the company’s substance.

On the interpretation of Figure 2:

- Quadrant A: Companies in this quadrant are likely to have a sustainable level of operational efficiency in the medium term, combined with an acceptable to very low risk of default within the next 12 months.

- The corporate substance (CS) is a measure of medium-term sustainability based on operational efficiency and competitiveness.

- The Financial Risk Rating (FRR) is a measure of the short-term default risk. This is derived from the CS and the resilience analysis and makes statements about the company’s ability to meet internal and external obligations in the short term.

In this management summary, we have shown what information is available to companies through BAMAC Group’s Financial Risk Report. The blog series continues with the historical FRR and the analysis of the performance categories. All other blog posts can be found below.

Categories of this post

Further interesting posts.