Sample report part 6: FRR liquidity analysis

This excerpt from the Financial Risk Report looks at the liquidity situation of Muster AG and puts it into context. The BAMAC GROUP’s Financial Risk Report is the tried and tested tool for a comprehensive assessment of your suppliers.

Liquidity analysis in the Financial Risk Report

Within the Financial Risk Report, BAMAC Group carries out numerous investigations in order to guarantee a comprehensive supplier evaluation. In this excerpt from the Financial Risk Report, we present the liquidity analysis of Muster AG.

Liquidity situation of Muster AG

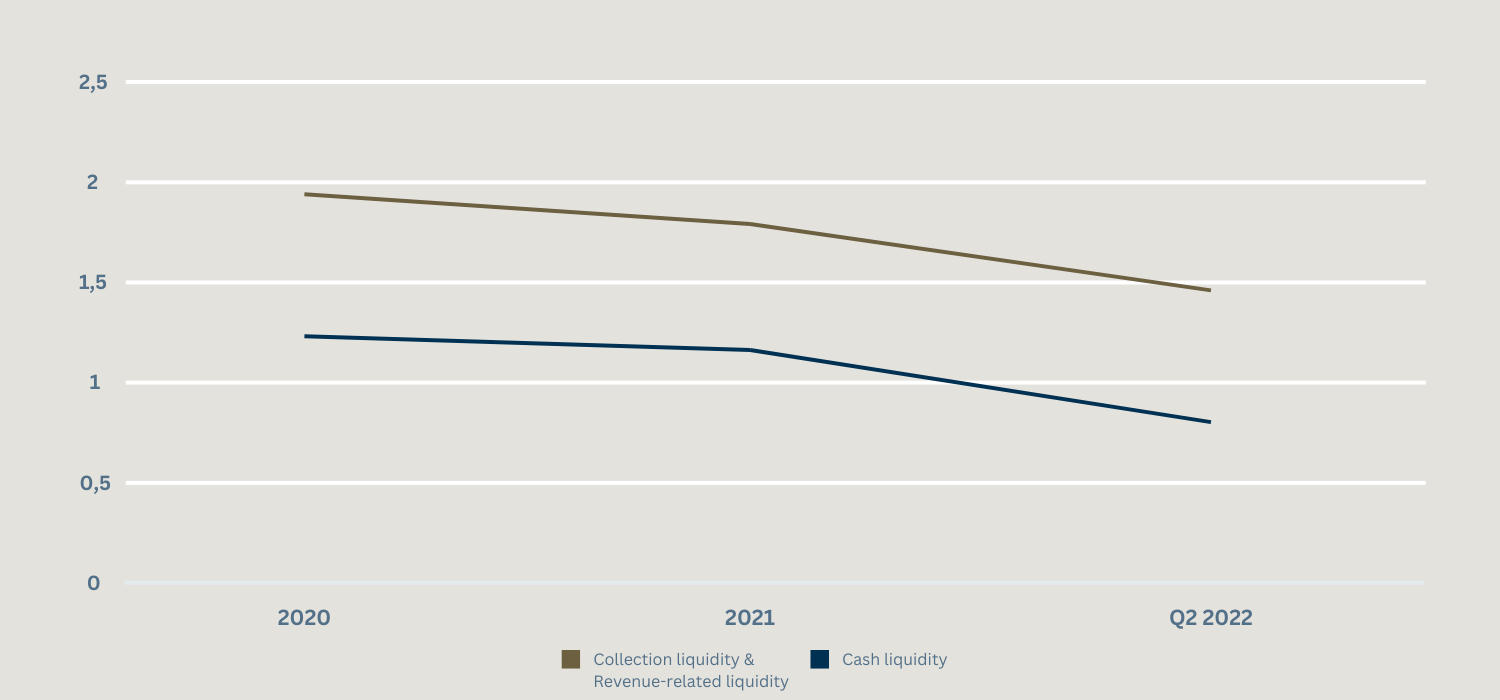

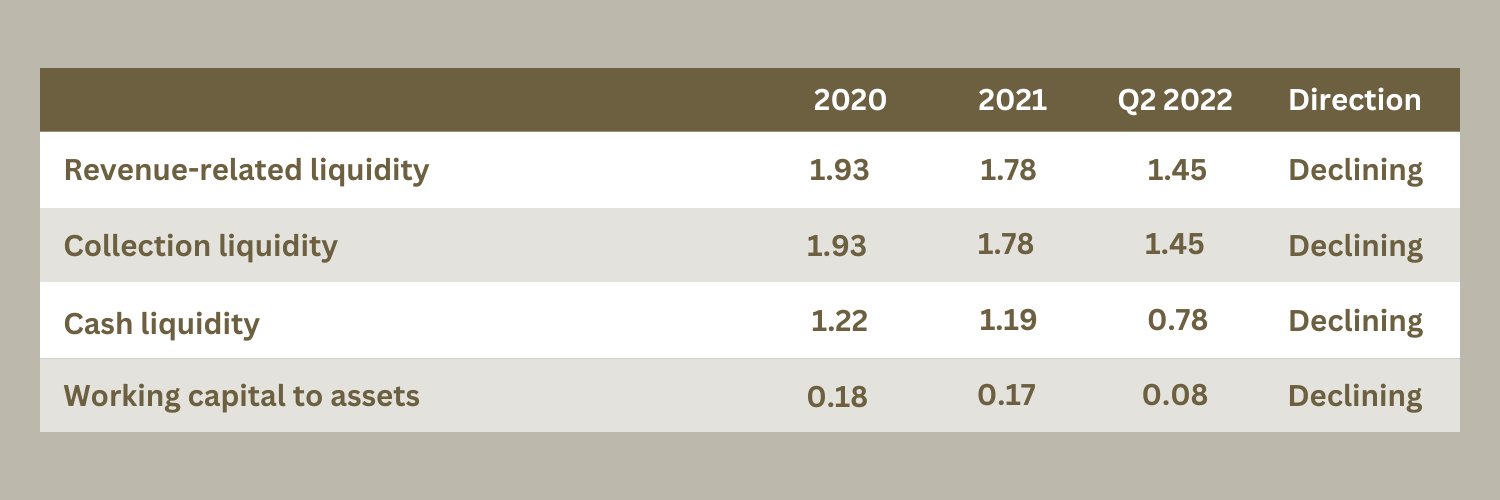

The liquidity analysis of Muster AG has shown that this is satisfactory in view of the measured average company substance. It should be noted that both the company’s working capital and cash liquidity have fallen. The figure illustrates this development.

Specifically, the liquidity analysis shows that Muster AG has a cash liquidity of 0.78. This means that EUR 0.78 in cash is offset by EUR 1.00 in current liabilities. This means that the company has a high level of cash liquidity in relation to its current liabilities. This ratio is often referred to as the “liquidity ratio” or “cash-to-short-term liabilities ratio”.

In this case, a liquidity ratio of 0.78 means that Muster AG is able to settle almost 78% of its current liabilities from existing cash and cash equivalents. This is an appropriate level of liquidity and can be regarded as solid. It indicates that the company is in a position to meet its short-term financial obligations without running into liquidity bottlenecks.

A high liquidity ratio of more than 1.0 would mean that the company has more cash than current liabilities, which would indicate a very strong liquidity position. These are the results of liquidity analyses in the past, as shown in the table.

Reasons for the liquidity analysis

The cash liquidity of a company refers to the amount of cash and cash equivalents available to the company at the time of an analysis. As it reflects its ability to meet short-term obligations, it is an important measure of a company’s financial health. Liquidity analysis is therefore an integral part of BAMAC Group Financial Risk Report.

In the next part of the Financial Risk Report blog series, we will look at and evaluate the key figures for receivables processing and asset utilization at Muster AG. All other blog posts can be found below.

Categories of this post

Further interesting posts.