D.Risk – FRR

Get clarity – with the BAMAC Group’s Financial Risk Report (FRR).

Can your suppliers meet the current financial challenges as a company? Is your supplier financially stable enough for the planned collaboration?

An effective supplier evaluation helps companies to identify risks and take appropriate measures to minimize them. A key aspect of this assessment is the financial health of suppliers. Questions that are of central importance in the evaluation of suppliers are:

– How likely is it that your suppliers will get into financial difficulties?

– Do your suppliers have the necessary substance to overcome unexpected challenges?

– To what extent are current events such as the coronavirus pandemic, supply bottlenecks, and high energy prices affecting the reliability of your supplier?

The BAMAC Group’s Financial Risk Report offers you a reliable evaluation basis based on objective analyses, which you can use to evaluate your suppliers, assess risks and establish and expand promising relationships.

Excerpt: Sample report of Muster AG.

Below you will find an insight into the management summary template of our supplier assessment “Financial Risk Report”.

Muster AG

Financial period: June 30, 2022 / fiscal period Q2 2022

FRR Creation date: July 28, 2022

Stock exchange symbol: MAG

Sector: IT services

Address: Muster Allee 14, 10110 Musterstadt, Germany

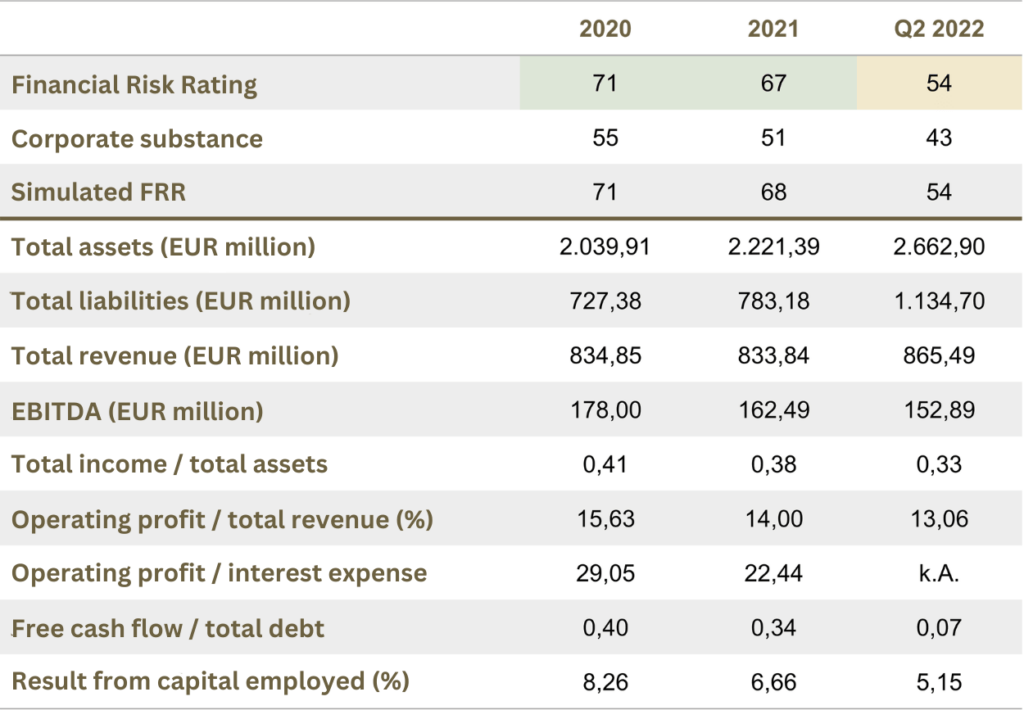

FRR: 54

Risk level: Medium

Forecasted probability of default: 0.19%

Annual delta: -12 rating points

Company substance: 43 (Medium)

Average probability of default with average company substance.

Our rating: The Financial Risk Rating (FRR) of Muster AG is 54 (0 = very high default risk,100 = very low default risk) for the four quarters until June 30, 2022, which corresponds to a downgrade of 12 points compared to the previous year. This supplier rating puts the company in the upper half of our medium risk group, with an estimated probability of default of 0.19% over the next 12 months. The FRR and the default risk are the result of an average corporate substance with an appropriate level of debt, liquidity and profitability.

The Financial Risk Report: your tool for fact-based decisions.

Summary

Medium default risk & medium company substance: A company substance with a rating of 43 indicates an acceptable level of efficiency of the rated company. In the long term, however, this rating also requires improvement if Muster AG is to remain viable. There is adequate performance within the resilience indicators. These resilience indicators are particularly relevant when considering the risk of default. Companies with this combination of corporate substance and resilience have an acceptable risk of default within the next year, combined with comparatively modest medium-term prospects.

Sufficient resilience: Muster AG has sufficient performance capabilities in terms of leverage, liquidity and earnings development. This is an acceptable result for a supplier evaluation.

Relative underperformance in the generation of returns: At 5.15%, the return on capital employed (ROCE) for the most recent period represents a relative underperformance and is a significant decline compared to the previous full year, which was the low point of the period under review at 8.26%. This figure is well below the high of 15.95% reached in the second quarter of 2013. In the last three years, the range was between 5.15% and 13.96%.

Average company substance: In the past 12 months, starting from June 30, 2022, Muster AG has suffered a moderate decline in company substance (US). The decline of 9 points in the US is largely due to a deterioration in operating profitability, net profitability and the profitability and efficiency of the capital structure. The efficiency of the cost structure is at a high level compared to the global data set. This area makes an important positive contribution to the overall strength of the company. Muster AG shows weaknesses in capital structure efficiency and operating profitability in a global industry comparison.

Inconsistent cash flow: While Muster AG generated a positive cash flow from its operating business in the last financial year, its overall performance was inconsistent. Payment coverage for investments was very high, whereas debt coverage was modest.

The bottom line: Muster AG is in the upper half of our medium risk group of evaluated suppliers with a mixture of strong and weak performance categories. The company has a relatively underperforming ROCE and was downgraded in the last period. If current trends continue, it is to be expected that Muster AG will be confronted with a medium to moderate default risk in the coming year. The prospects for efficiency and competitiveness are promising in the medium term, which is why the outlook for the company is rated as positive.

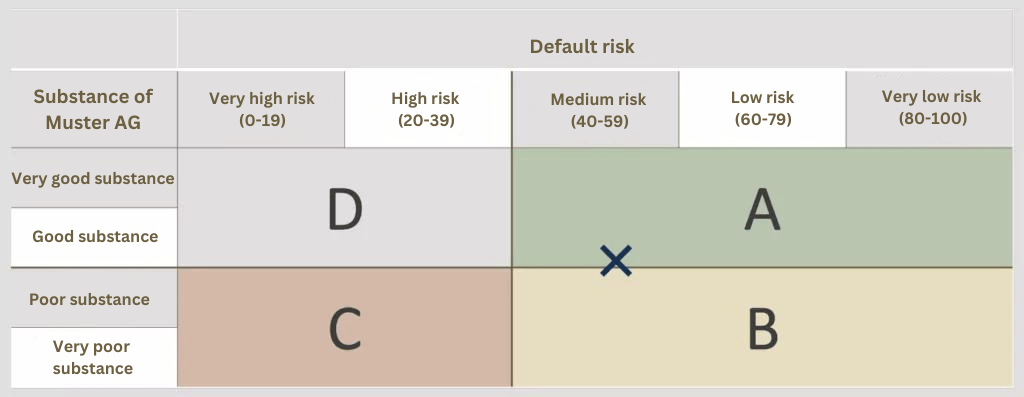

Figure 2: Company substance & quadrant analysis of the probability of default

The Financial Risk Report, our supplier evaluation tool, provides you with a detailed risk assessment.

Quadrant A: Companies in this quadrant are likely to have a sustainable level of operational efficiency in the medium term, combined with an acceptable to very low risk of default within the next 12 months.

The corporate substance (US) is a measure of medium-term sustainability based on operational efficiency and competitiveness.

The Financial Risk Rating (FRR) is a measure of the short-term default risk. This measure is derived from the US and the resilience analysis and provides information on the company’s ability to meet internal and external obligations in the short term.

Need Help?

Monday through Friday from 08:00 - 18:00

D. Risk FRR: Assessing and managing risks.

| Basis | Standard | Premium | Platinum | |

| Number of reports/year* | 25-49 pcs | 50-99 pcs | 100-149 pcs | 150-199 pcs |

| Costs per Public Report | 3.486 EUR | 2.847 EUR | 2.019 EUR | 1.744 EUR |

| Costs per Private Report | 3.716 EUR | 3.095 EUR | 2.267 EUR | 1.998 EUR |

| Update Public Report | 994 EUR |

| Update Private Report | 1.139 EUR |

| Benchmarking Report NEW | On request |

| Outsourcing check** | On request |

| Supply Chain Act | On request |

| IT performance of suppliers | On request |

All prices are exclusive of VAT.

*) One year refers to a financial year with a term of 01.01. by 31.12.; it is not possible to carry forward unused reports to the following year. If you require fewer than 25 reports or more than 200 reports, please contact us for a customized quote.

**) Supplier audit as an element of the outsourcing audit, e.g. BaFin Circular 2/2017, 1/2020

FAQ

What data is included in the analysis for the Financial Risk Report?

The evaluation of suppliers is based on the following data for the period to be evaluated:

- Balance sheet (in particular: current and non-current liabilities)

- P&L

- Cash flow analysis

What is the difference between a “public” and a “private” company?

When classifying companies, we distinguish between “private” and “public” companies.

“Private” companies: “Private” companies are companies that are not publicly traded on the capital market (e.g. GmbH, GmbH & Co. KG, OHG, private AG).

“Public” companies: Public” companies are companies that are publicly traded on the capital market (usually listed companies / e.g. AG, SE).

What does the “probability of default” describe?

The probability of default measures the risk of a payment default when granting a loan.

What steps does the process for creating the FRR involve?

The process for preparing the FRR essentially comprises the following steps:

- Receipt – Sending the order information to BAMAC

- Inspection – basic inspection results in the order confirmation and the expected delivery date

- Data collection for public/private companies

- Data analysis

- Create report

- Handover – Report to customer

For which countries can financial reports be prepared?

We have 376 financial risk reports from companies in Germany.

In addition, we can prepare reports for private and public companies once the key financial figures have been submitted.

We have 3,278 financial risk reports from companies in Europe. Worldwide, we have 17,808 financial risk reports from companies.

In addition, we can prepare reports for private and public companies once the key financial figures have been submitted.

In which languages are the reports made available?

By default, the reports are available in German and English. Other languages are available on request.

Find out more about the details of the Financial Risk Report in our blog series