Sample report part 2: Historical FRR and analysis of performance categories

We at the BAMAC GROUP help you to assess the financial risk rating of your suppliers as well as their default risk in order to ensure a secure supply chain. In this article, we take a look back and examine the development of the financial risk rating of the Muster AG and analyze the performance categories.

Part 2 of the Financial Risk Report

In this article, we take a look back and consider how the company Muster AG in our example of the Financial Risk Report has developed in recent years. More specifically, in this Part 2 we look at the development of the financial risk rating of Muster AG and analyze the performance categories.

How well do you know your suppliers?

We have already explained in detail the importance of securing the supply chain for the success of your company. Suppliers play a crucial role for companies by providing raw materials, components and services. A comprehensive supplier evaluation therefore helps to minimize risks and ensure the reliability of the supply chain.

We at BAMAC Group help you to assess the financial risk rating of your suppliers as well as their default risk. So that you can ensure a secure supply chain. The tried and tested instrument for this is the Financial Risk Report.

In our blog series, we have already provided an insight look into the management summary of the report. Now, in the second part of our series, we present the development of Muster AG’s Financial Risk Rating (FRR) and analyze the performance categories before we examine the company’s substance in detail in the next part.

Historical FRR and analysis of performance categories

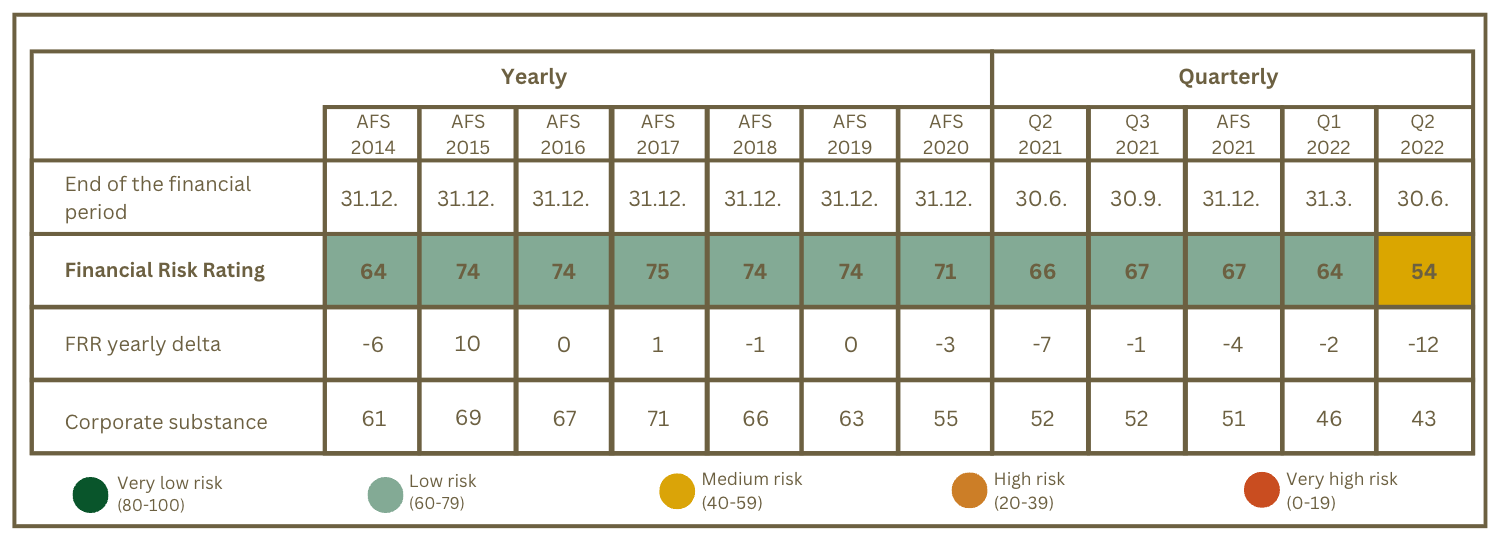

A historical perspective makes perfect sense when valuing companies. This shows whether positive and negative growth trends were already foreseeable or have suddenly emerged due to a change in circumstances. The tables below show that, after years of growth, Muster AG’s risk rating only fell in the last survey period. The table shows the development of the financial risk rating (FRR) and the performance categories for Muster AG. Each measurement period is marked with the end of the financial period of the most recent financial reports included in the respective FRR. As can be seen, the FRR has decreased significantly after stable years and has fallen into the medium risk range.

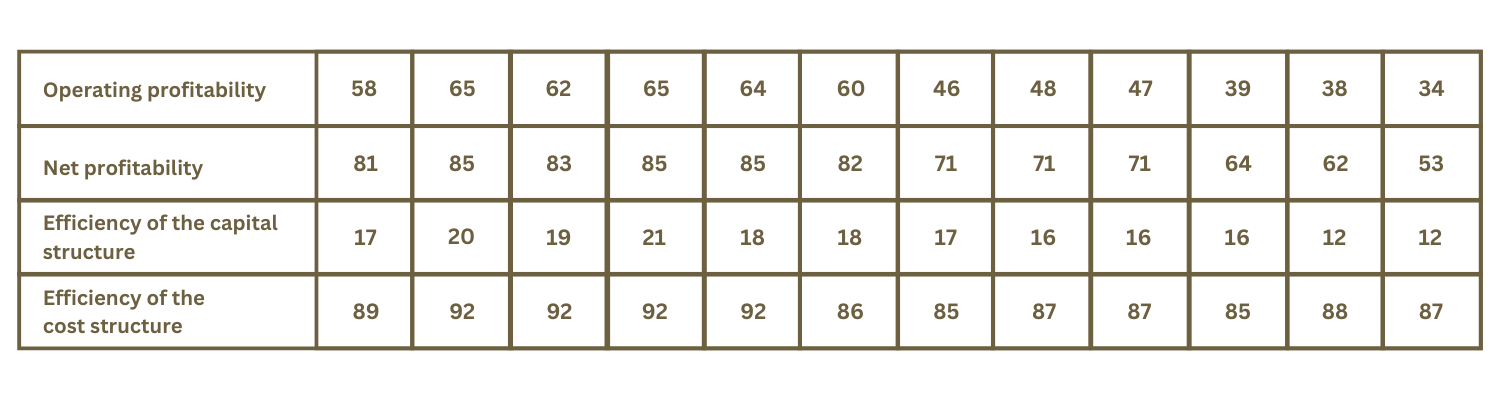

Corporate substance is based on an analysis of efficiency and competitiveness, while resilience is based on empirical correlations with the probability of default. The two perspectives are not always congruent and interact dynamically in their contribution to the overall financial risk. It is also appropriate to take a comprehensive approach when assessing the financial risk rating.

This downward trend can also be seen in the values used to determine the substance of the company. Both the operating and net profitability ratios and the efficiency of the capital and cost structure have fallen in equal measure.

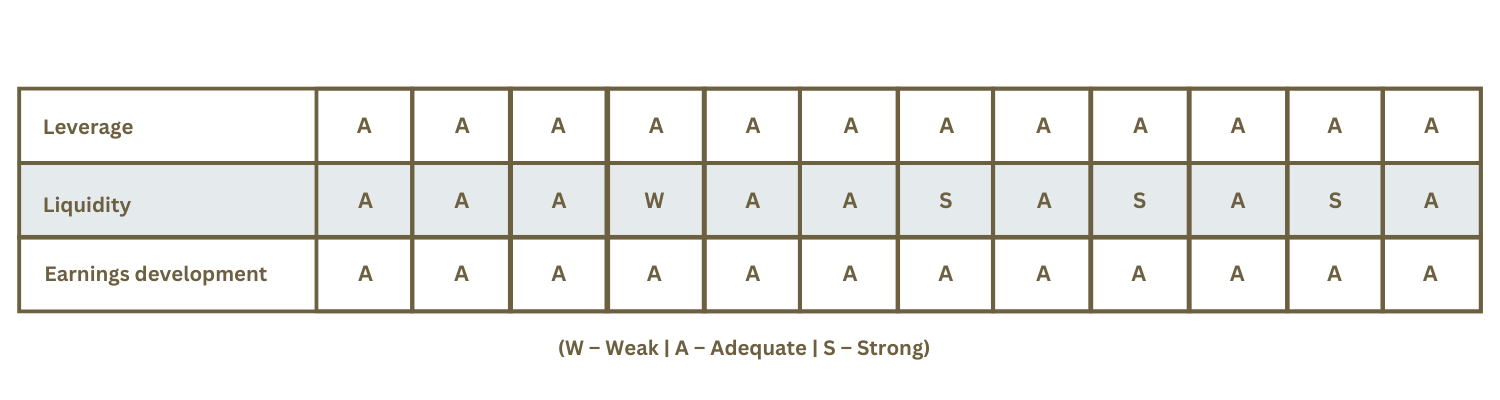

By contrast, the resilience indicators leverage and earnings performance have remained stable from a historical perspective. Only liquidity fluctuates both in the lower range in 2017 and in the upper range for Q3 2021 and Q2 2022.

This is just one part of BAMAC Group’s Financial Risk Report. In the third part of our series, we present the analysis of the company’s substance in detail. You can find all other blog posts of the series below this one. And if you want to discuss any of your current risk management challenges, we will be more than happy to talk to you. Simply contact us and we will get back to you immediately.

Categories of this post

Further interesting posts.