Sample report part 3: FRR analysis of the company substance

BAMAC Group’s Financial Risk Report is the proven tool for supplier evaluation. To give you a precise idea of the report and its benefits, we present it in detail here. This article takes a closer look at Muster AG: Current areas of strength and weakness compared to past performance are highlighted.

Analysis of the substance of the company

In this article, we analyze the corporate substance of Muster AG. Current areas with strengths and weaknesses compared to previous performance and other industry players are highlighted. The sector leaders and laggards show the performance of companies in the top and bottom decile of the sector for this performance indicator.

Financial Risk Report Part 3

BAMAC Group’s Financial Risk Report is the proven tool for supplier evaluation. We have already explained the advantages of supplier evaluation for a company’s success in detail before. You can also find an overview of all parts of the Financial Risk Report and their detailed descriptions here.

Analysis of the company substance – strengths of Muster AG

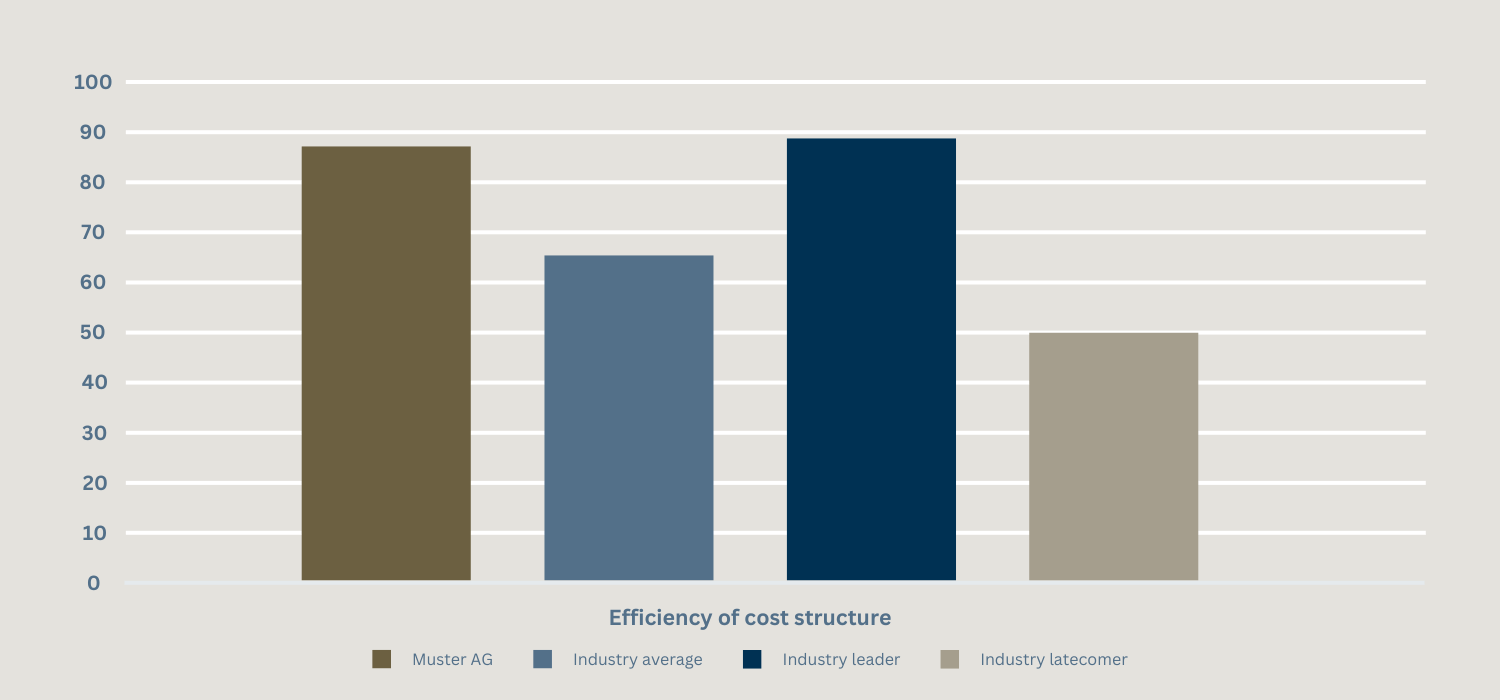

First, we present the strengths of the evaluated company. In the case of Muster AG, it is noticeable that the company’s cost structure is particularly efficient. The overall assessment of the cost structure is based on a series of key figures. Variables such as production costs, personnel costs, other operating expenses, depreciation, interest expenses and corporation tax are taken into account in relation to a base such as total revenue and total expenses. The chart illustrates the very good cost structure of Muster AG compared to the rest of the industry.

We then highlight the weaknesses of the company being valued. The analysis of the corporate substance of Muster AG revealed that there is potential for improvement both in the efficiency of the capital structure and in the operationalized profitability of Muster AG.

Weaknesses of Muster AG

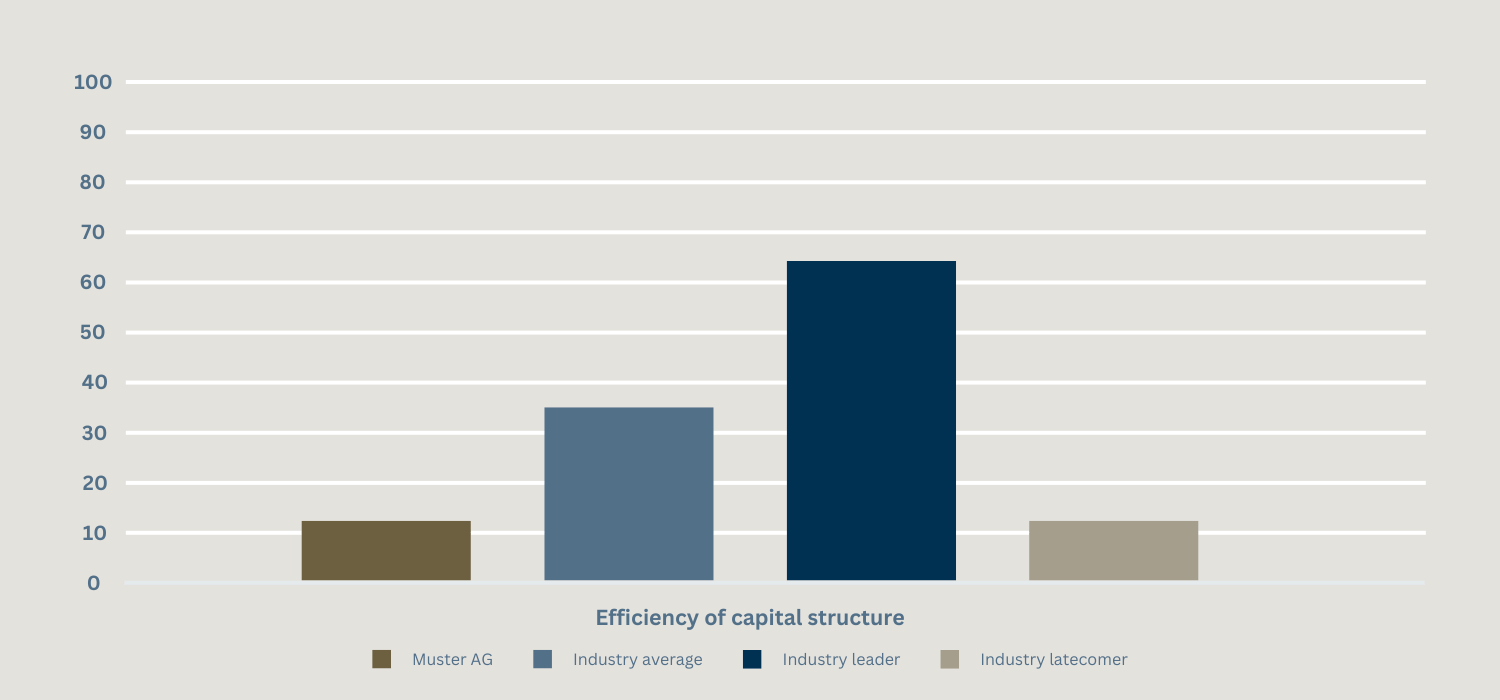

Capital structure efficiency as part of the corporate substance examines the main elements of the capital structure in relation to various fundamentals such as total capital employed, operating performance, total liabilities and total assets. The capital tax is made up of the following key figures: current and non-current liabilities, total liabilities, equity, current assets and total assets. The evaluation of Muster AG shows a company that only corresponds to 12% of the best practice profile of the global reference group in the last 12 months up to June 30, 2022. The figure shows that this result is well below the industry average.

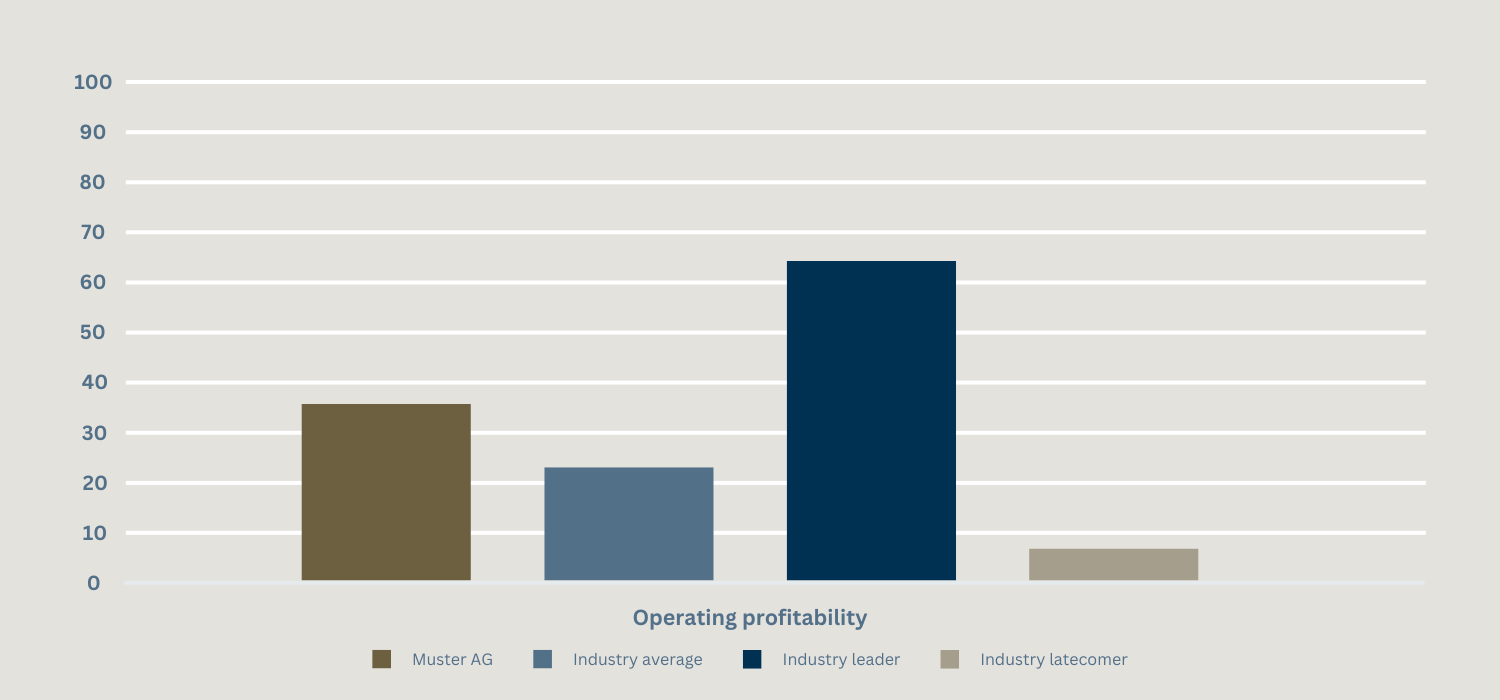

The key figures for operating profitability are better. Operating profitability provides an upstream analysis of efficiency in generating profitability and comprises gross profit, EBIT and EBITD in relation to several key denominators. These are, in particular, the capital employed, equity, total assets and operating income. Here, Muster AG is above the industry average, but still far below the performance of the industry leaders. More precisely, Muster AG has a 34% match of the best practice profile with the global reference group in the last 12 months up to June 30, 2022.

With regard to the substance of the company, we used the Financial Risk Report to identify weaknesses in the area of operating profitability and the efficiency of Muster AG’s capital structure. In the next part of our blog series, you can find out how the abnormal items in the balance sheet of Muster AG affect its FRR. All other blog posts in the series can be found below.

Categories of this post

Further interesting posts.