Sample report part 5: FRR cash flow analysis

Within the Financial Risk Report, BAMAC Group carries out numerous investigations in order to guarantee a comprehensive supplier evaluation. In this article, we present the results of the cash flow analysis of Muster AG.

Cash flow analysis in the Financial Risk Report

The Financial Risk Report‘s numerous investigations, which guarantee a comprehensive supplier assessment, also include a cash flow analysis. Here we present the results for Muster AG.

Cash flow of Muster AG

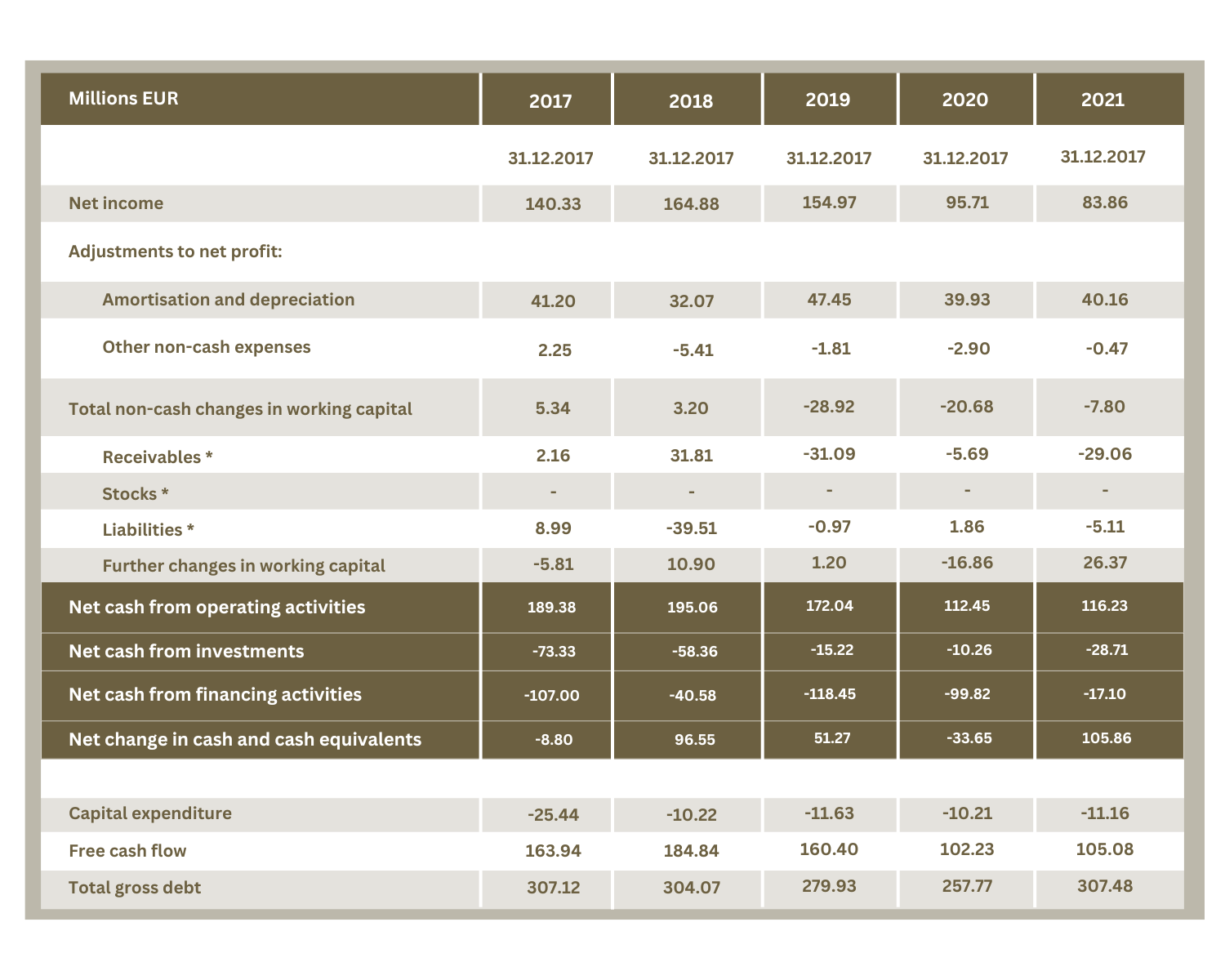

As at December 31, 2021, the analysis confirms a positive cash flow outlook for Muster AG. The company generated a positive cash flow at a good level in the last financial year. The coverage of investment expenditure by internally generated cash flow was exceptionally high at more than 400%. In addition, the free cash flow covered the debt to a high degree. It is noticeable that capital expenditure is drastically lower than depreciation in the current year, which may indicate a considerable degree of underinvestment.

The free cash flow of Muster AG

Free cash flow is the cash flow that a company can generate after considering the costs of maintaining or expanding its assets. The analysis of the free cash flow of Muster AG showed that it has been positive in the last 5 years. It ranged from a high of EUR 184.84 million in 2018 to a low of EUR 102.23 million in 2020. In the last 12 months, ending with the annual financial statements for the 2021 financial year, free cash flow rose from EUR 102.23 million to EUR 105.08 million.

* In some cases, these figures may be estimates derived from balance sheet data.

The debt burden of Muster AG

As already indicated above, it is necessary to include the debt burden if a cash flow analysis is to be carried out. For Muster AG, the debt burden rose from EUR 257.77 million in 2020 to EUR 307.48 million in 2021. Free cash flow also increased.

However, the ratio of free cash flow to total debt fell, as the increase in debt exceeded the growth in free cash flow. Nevertheless, ratios of free cash flow to debt in this order of magnitude generally indicate a solid solvency profile.

The cash flow analysis within the Financial Risk Report revealed the following:

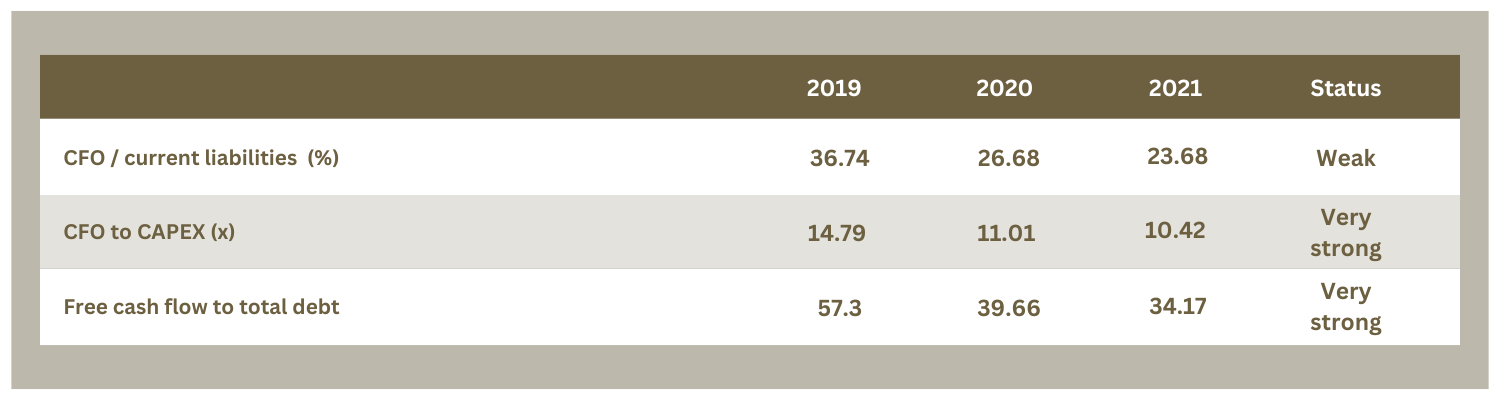

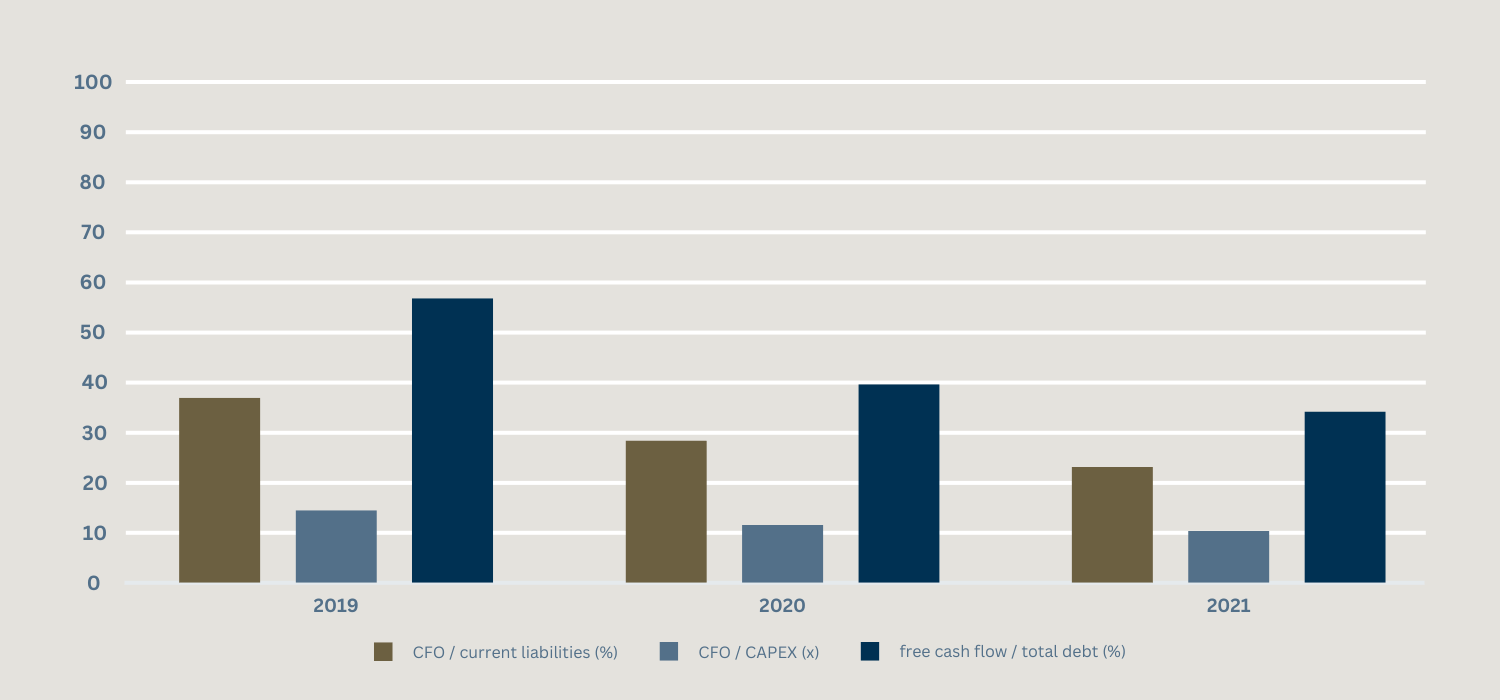

The ratio of CFO (cash flow from operating activities) to current liabilities is 23.68%. This indicates weak cash flow coverage, as the cash flow from operating activities can only cover part of the company’s current liabilities. If we compare the cash flow from operating activities (CFO) with capital expenditure (CAPEX), we obtain a ratio of 10.42 which indicates very strong cash flow coverage. The CFO is more than sufficient to cover the company’s capital expenditure. In other words, it can be concluded from this that the company is able to finance investments from the cash flow generated, which in turn indicates a solid financing basis. The ratio of free cash flow to total debt of 34.17% also means strong cash flow coverage. The specific figures can be seen in the table.

In summary, these key figures show different aspects of the company’s cash flow coverage. While the coverage of current liabilities may be weaker, the ability to cover investments and the coverage of total debt by free cash flow indicates a stronger financial position of the company. The figure above illustrates this once again.

The next part of our Financial Risk Report blog series is the liquidity analysis. A complete overview of all parts of the Financial Risk Report can be found further below.

Categories of this post

Further interesting posts.