Sample report part 7: Activity relationships in the FRR

This article is dedicated to the section of the Financial Risk Report that examines the activities of Muster AG. We take a look at the key figures for receivables processing and asset utilization and show findings result from this analysis.

Activity relationships of Muster AG

In order to evaluate the efficiency of your suppliers’ financial management, a comprehensive view is required. We have already given you a broad overview of the Financial Risk Report (FRR), now we want to dive into the details of one part of the FRR: the employment relationships of Muster AG. We look at the key figures of Muster AG for receivables processing and asset utilization.

Analysis of employment relationships

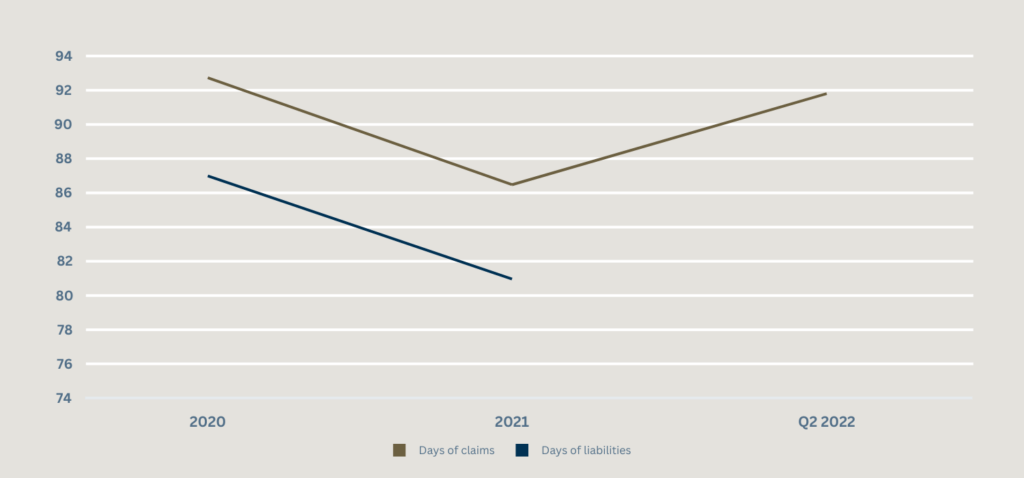

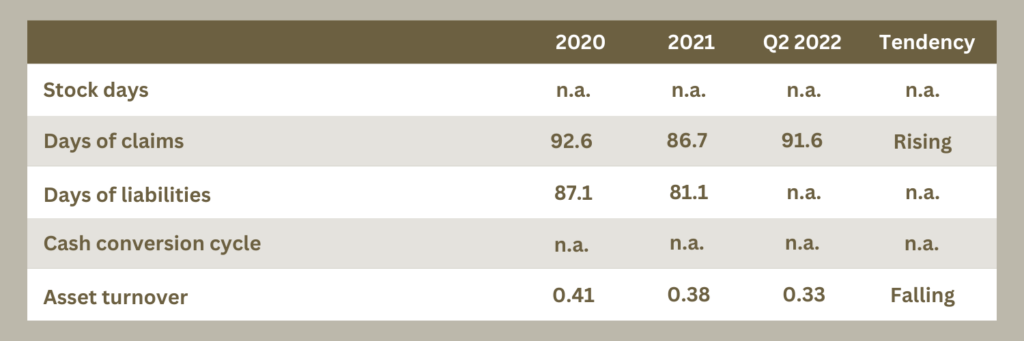

The analysis of Muster AG’s business relationships has shown that the collection periods have increased, i.e. Muster AG has to wait longer for its customers to settle their invoices. At the time of the investigation, Muster AG had 91.62 days of receivables outstanding. The figure illustrates this development.

If we look at the activity ratios for asset turnover, we see that the company has generated EUR 0.33 for every euro of assets in the last 12 months. The table shows that performance in this key figure is declining. In other words, Muster AG generated less turnover per euro of its assets last year compared to previous periods.

In contrast, both the table and the figure show that although the days of receivables are increasing, they were at an even higher level in 2020 than in the period under review.

Significance and effects

Days sales outstanding: We discuss the impact of delayed payments on the liquidity and working capital of Muster AG. The aforementioned 91.62 days of receivables outstanding at Muster AG represent a challenge. This is because a longer receivables term can adversely affect the financial position and may require adjustments to payment processing.

Asset turnover and efficiency: Here we look at how a falling asset turnover indicates that the company may be becoming more inefficient. This may indicate operational challenges or inefficient use of capital. The fact that Muster AG generates only EUR 0.33 in sales per euro of assets illustrates its declining efficiency.

Measures and recommendations

Optimization of receivables processing: We suggest possible measures to shorten receivables processing times, as well as improved receivables management and clearer payment terms to reduce the number of days in arrears.

Increasing the efficiency of asset turnover: Various strategies can be discussed here to improve asset utilization, such as investing in more efficient operations or reviewing asset allocations.

Conclusion

As shown, the activity ratios for key figures such as days sales outstanding and asset turnover also provide important information on the financial health and efficiency of a company. This example shows that Muster AG could improve its performance and ensure long-term success through targeted measures.

For Part 8 of the exemplary Financial Risk Report, in which we examine the return on the invested assets of Muster AG. Find all other parts of the FRR below this post.

Categories of this post

Further interesting posts.