The importance of a dynamic end-to-end view in companies

Discover the importance of end-to-end processes for your company’s success. Learn how holistic processes increase efficiency, reduce costs and create competitive advantages. Practical examples and expert tips for optimal implementation in various industries.

Value is created in a company not in an isolated area, but end-to-end along the value chain. But what is the meaning of end-to-end?

In the modern business world, especially in large companies, the term “end-to-end view” or “end-to-end processes” is increasingly heard. Many business units are striving to permeate processes from start to finish in order to increase efficiency, transparency and effectiveness. But what is the real meaning of end-to-end? The term describes a comprehensive view of an entire process – from its starting point to its conclusion. However, reality shows that the definition of what is considered the beginning and end depends heavily on the context. An end-to-end view is therefore dynamic and is often interpreted differently depending on the level or area of responsibility.

The context decides: Different end-to-end perspectives

A key aspect of an end-to-end view is that it always depends on the point of view of the observer. An employee or department may have an end-to-end view of a process that extends from start to finish for them, while the same process in a larger organizational perspective is merely a part of a broader end-to-end process. The challenge is to understand and integrate these different views and meanings of end-to-end.

To make this more tangible, let’s take a detailed look at an example from the insurance industry, where several levels of an end-to-end view are presented.

Example: End-to-end in the insurance industry

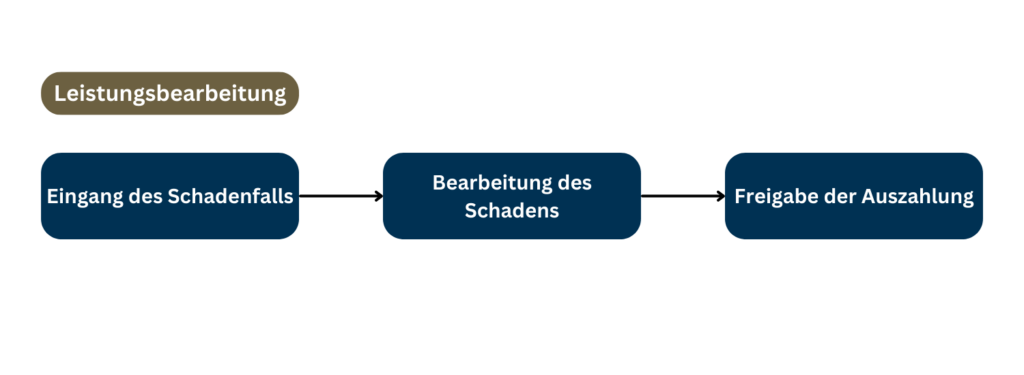

Let’s imagine that an employee in the claims settlement department of an insurance company processes claims. From his perspective, the end-to-end process begins when the claim is reported and ends as soon as the claim is settled. This perspective includes:

- Receipt of the claim: The claim is reported, recorded and forwarded to the responsible office.

- Processing of the claim: The claim is checked, the conditions of the insurance contract are analyzed and the amount of the possible payout is determined.

- Release of the payout: The decision on the payment is made and the money is transferred to the customer.

This represents an end-to-end view that appears self-contained and includes all relevant steps that the employee can influence. The diagram illustrates the importance of end-to-end once again.

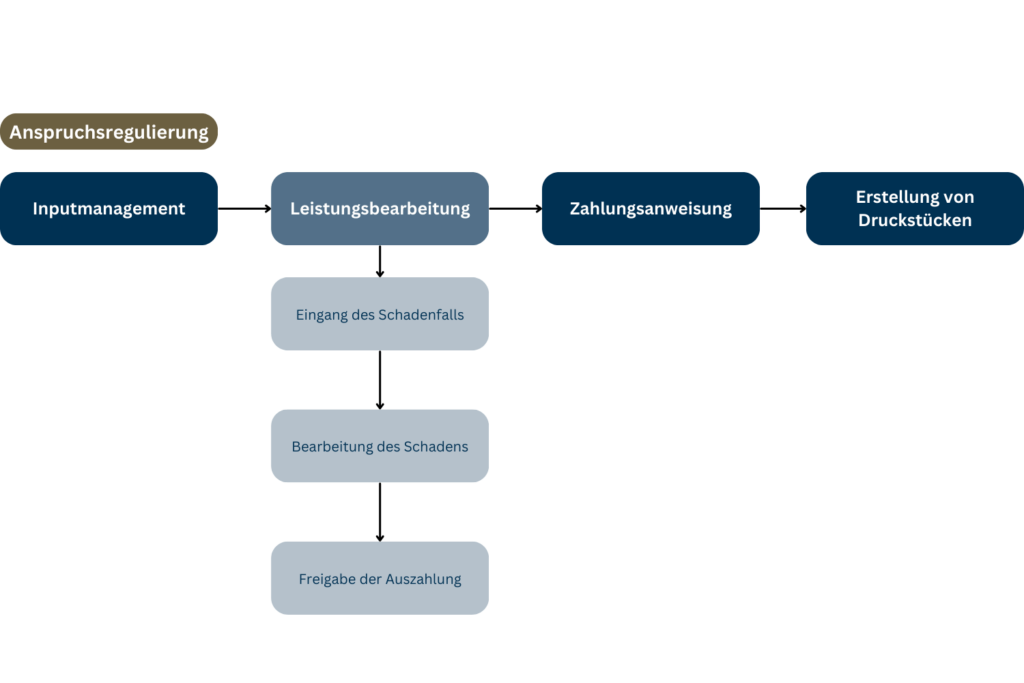

The next level: The claims settlement process

However, this claims handling process is only one part of the overall end-to-end claims settlement process. This is where other departments come into play and the whole process becomes more complex. Claims settlement could look like this:

- Input management: The claims notification is recorded, pre-checked and forwarded to the claims handler.

- Service processing: The employee from the previous example takes over here.

- Payment instruction: As soon as the service processing procedure has been completed, the payment instruction is issued.

- Creation of printed documents: Corresponding letters or documents are sent to the customer for confirmation.

From the perspective of a manager who is responsible for the entire claims settlement process, the end-to-end process begins with input management and only ends with the dispatch of the final documents. The illustration below also makes it clear that the end-to-end view of the employee in the claims area presented first is only a partial view of the overall process.

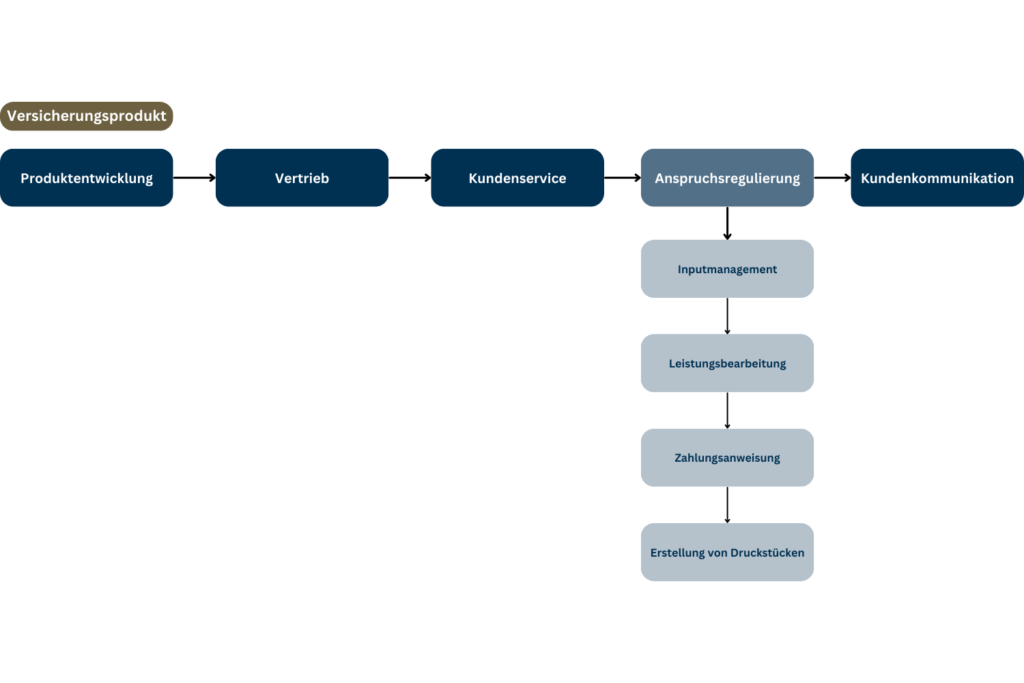

One level higher: end-to-end view of the insurance product

In addition to claims settlement, there is another meaning of end-to-end, namely the entire insurance product. Here, the process begins much earlier, for example during the development and design of the product. This overarching end-to-end process includes:

- Product development: The product is designed, calculated and made ready for the market.

- Sales: The product is sold to the customer, either by an advisor or via digital channels

- Customer service: After the contract has been concluded, customer service is available to answer questions or make changes to the contract.

- Claims settlement: When a customer reports a claim, the claims settlement process described above comes into play.

- Customer communication: Finally, further customer support is provided via various channels.

From this overarching perspective, the claims settlement process that the employee focuses on becomes part of a much more comprehensive end-to-end process that encompasses the entire life cycle of the product. The following graphic illustrates this.

The strategic end-to-end view of the company

Finally, at the highest level is the strategic end-to-end view of the company. This is no longer about individual products or services, but about the company’s overall direction. At this level, you look at:

- Overall strategy: Which markets does the company want to serve? Which new products are to be developed?

- Innovations: How can the company integrate new technologies to improve processes?

- Customer focus: How can the customer be optimally supported throughout the entire process to ensure long-term customer loyalty?

The importance of end-to-end at this level extends across all company divisions, products and markets. This is where strategic decisions are made that ultimately influence all end-to-end processes in the company.

The change in perspectives

A crucial point about the end-to-end approach is that it is not static. Processes, responsibilities and interfaces are constantly changing – especially due to technological developments or market changes. An end-to-end view today is therefore often not the same as it will be a year from now.

To illustrate this, we present further practical examples from various sectors below.

Example 1: Introduction of AI-supported processing in the insurance industry

The introduction of artificial intelligence (AI) in the insurance industry is a prime example of how dynamically the end-to-end view of a process can change. The idea behind AI-supported processing is to automate repetitive and standardised tasks, thereby reducing the workload of the clerk and speeding up the process. Let’s take a look at the details:

Before the introduction of AI:

- Claims notifications: A customer submits a claim report, either by post, e-mail or telephone. These reports must be signed by employees.

- Checking the claim notification: Claims handlers check the notification, compare it with the conditions of the insurance contract and look for possible discrepancies or suspected cases of fraud.

- Decision: The claims handler makes a decision as to whether the payment is authorised or whether further information is required from the customer. The claim amount is then calculated and authorised for payment.

- Manual processing: Each of these steps requires human decisions, which makes the process time-consuming and more prone to errors.

After the introduction of AI:

- Automated processing: The damage report is received by the AI and analysed immediately. The system uses pattern recognition and historical data to identify similar cases and make an initial assessment.

- Check by algorithms: The AI automatically checks the claim for contractual compliance, potential fraud and all relevant details. External data sources, such as weather data (for accidents or damage caused by natural events), are also taken into account in real time.

- Automated decisions: In most standard cases, AI can make a decision to authorise payment and initiate the process to instruct without the need for human intervention. Only complex or unusual cases are forwarded to human clerks.

- Continuous improvement: Thanks to constant feedback from human processors, the AI learns and improves its decision-making over time. This makes the process more and more efficient.

Dynamic change in the end-to-end view:

The introduction of AI is changing the end-to-end view in several ways:

- Time efficiency: What used to take days or weeks is now done in minutes or seconds thanks to AI.

- Employee focus: The role of the human administrator is shifting away from processing everyday cases to reviewing complex scenarios and continuously improving the system.

- Customer perspective: Customers benefit from faster decisions and more transparent processing, as they can view the status of their claim at any time via a self-service portal.

The end-to-end process is therefore not only accelerated by the introduction of AI, but its structure is also dynamically changed. Employees and machines work hand in hand to ensure more efficient processing.

Example 2: Introduction of cross-institutional case management in the healthcare sector

In the healthcare sector, we often see cases in which a patient passes through various institutions – for example, from the emergency department to hospital, then to rehabilitation and finally to long-term care. Case management between these institutions is often fragmented and uncoordinated. The introduction of cross-institutional case management significantly changes the end-to-end view.

Before the introduction:

- Separate silos: Each institution works independently and has its own end-to-end view. For example, the hospital considers its end-to-end process to be complete as soon as the patient is discharged. The rehabilitation clinic only begins its process when the patient arrives. In between, there is little or no coordination.

- Lack of transparency: Information about the patient is often inadequate or delayed. Each provider has only limited insight into the patient’s overall condition or previous treatment.

- Lack of continuity: This leads to delays in treatment and an increased burden for the patient, who has to communicate their history and important information again and again.

After the introduction:

- Integrated processes: With cross-institutional case management, the entire treatment process is seamlessly coordinated. A centralised system ensures that all institutions involved have access to the same data and can monitor the patient’s status in real time.

- Patient-centred process: The patient is now seen as part of a continuous end-to-end process, from initial diagnosis to rehabilitation. Each institution sees the entire process and can access relevant information, which leads to better and faster decision-making.

- Early planning: For example, the rehabilitation clinic can make preparations while the patient is still in hospital, as it has access to the necessary information at an early stage. The transition is smooth and continuity of treatment is maintained.

Dynamic change in the end-to-end view:

With the introduction of case management, the end-to-end view is changing, as it is now cross-institutional:

- Transparency: Everyone involved has a full view of the entire process, which increases both the efficiency and quality of treatment.

- Patient-centredness: The patient is at the centre, and coordination between the institutions ensures that their needs and well-being come first.

- Shorter lead times: Unnecessary delays can be avoided through early coordination and automated processes (such as appointment bookings or rescheduling).

The process is thus dynamically expanded and links various players in a common end-to-end system that covers the entire patient journey.

Example 3: Introduction of blockchain in the supply chain

Blockchain technology has the potential to radically change end-to-end processes in logistics. By introducing a decentralised and transparent database, all parties involved in a supply chain can track where a product is and what steps it has gone through in real time.

Before the introduction:

- Separate systems: Each player in the supply chain – from the raw material supplier to the manufacturer to the end customer – uses its own systems to manage information. There is little insight into the status of products outside of their own control.

- Manual checks: Many processes are based on manual checks and paper documentation. This increases the likelihood of errors or delays.

- Lack of traceability: In the event of product recalls or quality problems, it is difficult to fully trace the origin or exact history of a product.

After the introduction:

- Transparent supply chain: With blockchain, all steps in the supply chain are recorded in a single, immutable ledger. Every stakeholder can access the information in real time and check the status of the product.

- Secure and decentralised: Blockchain offers a secure method of verifying transactions and ensures that no data can be manipulated. Every change is immediately visible and can be traced by all parties involved.

- Automation through smart contracts: With the introduction of smart contracts, certain processes can be triggered automatically. For example, a payment could be authorised automatically as soon as a certain delivery status is reached.

Dynamic change in the end-to-end view:

Blockchain makes the end-to-end view comprehensive and transparent:

- Traceability: Every stakeholder has a complete and secure view of the entire process, from production to delivery to the end customer.

- Trust and efficiency: As all information is verified and secure, trust between the parties involved is strengthened and there is less need for manual checks or intermediaries.

- Optimised processes: Real-time transparency allows decisions to be made more quickly and processes to be adapted dynamically to increase efficiency and customer satisfaction.

Example 4: Introduction of self-service portals in banks and insurance companies

The introduction of self-service portals is a classic example of how end-to-end processes are changing as a result of digitalisation. Customers are increasingly able to complete tasks themselves that previously required employees.

Before the introduction:

- Employee-centred processes: Customers had to contact an employee for every enquiry, be it a change of address, contract adjustment or claims notification. These employees were responsible for the entire end-to-end process, from receiving the enquiry to processing and final documentation.

- Low transparency for customers: The customer submitted their enquiry and had to wait for a response without knowing exactly what stage the process was at.

After the introduction:

- Customer-controlled processes: Customers can make their own enquiries via the self-service portal and complete many tasks immediately. This includes simple processes such as address changes, contract renewals or claims notifications.

- Transparency and control: Customers now have an insight into the status of their enquiries and can track progress at any time via the portal. This increases transparency and satisfaction.

- More efficient working methods for employees: Employees only take on complex enquiries or tasks that require manual checking, while everyday processes are automated via the portal.

Dynamic change in the end-to-end view:

The introduction of the portal changes the end-to-end view in various ways:

- Customer focus: The customer now actively takes over part of the end-to-end process and has a direct influence on how quickly certain tasks are completed.

- Changed role of employees: The end-to-end view of employees is changing so that they are more focussed on checking exceptions and improving the portal.

- Shorter throughput times: As many processes are controlled and automated directly by the customer, processing times are significantly reduced.

Example 5: Digitalisation and AI in contracting

Maintaining and managing contracts is a challenge for many companies. As contracts are the legal basis for business, they are of great importance. A distinction must be made between different types of contracts, such as contracts with customers, suppliers, etc.

Before the introduction:

- Lack of systematisation: Contracts are filed in different formats in a decentralised manner. If they are physically filed in a filing cabinet, they are sometimes only accessible to one employee. There is no clear assignment of which employee is responsible. Contracts can be found in sales (contact with the customer), the legal department (contract creation) and in operations (fulfilment of the contract).

- Heterogeneity: The conditions granted in the contracts are very different, even though standardised products are sold.

- Risk: There is no transparency about the contract status and obligations to be fulfilled.

After the introduction:

- Transparency: The contract life cycle is viewed and recorded holistically. All employees involved have the same status regarding the contract.

- Easier work: The use of AI enables scanned contracts to be analysed and negotiated conditions to be linked to the master data.

- Proactivity: The status of the contract can be viewed digitally. Options for action can be derived from this, e.g. when renegotiations make sense.

Dynamic change in the end-to-end view:

The end-to-end approach enables a holistic view from the conclusion of the contract to its fulfilment:

- Standardisation: The introduction of digital templates increases quality. The short-term availability of contracts is guaranteed

- Risk assessment: The contract is extended or terminated after analysing the contract concluded and the changing framework conditions.

- Perspective: After fulfilment of the contract, archiving ensures that employees can access old contracts.

Conclusion: Choosing the right end-to-end perspective

As we have shown, choosing the right end-to-end perspective is not just a question of objectives. The opportunities offered by digital transformation also have an impact on end-to-end processes and their significance.

For example, an employee who focuses on optimising a specific part of a process needs a different perspective than a manager who keeps an eye on the overall picture. It is important that everyone is aware of which level they are at.

Only by understanding the different levels of an end-to-end view and its dynamic nature, which is accelerated by digital transformation, can a company effectively organise its processes and react flexibly to changes.

Let us uncover the potential of your processes together and develop a customised strategy that increases efficiency, effectiveness and profitability. With almost 30 years of experience as IT management and strategy consultants, we are at your side to understand your individual requirements and make the most of digital transformation. Contact us today to future-proof your organisation!

Categories of this post

Further interesting posts.